Home » Posts tagged 'renewable energy'

Tag Archives: renewable energy

Building a Failsafe Energy Grid post-Brexit

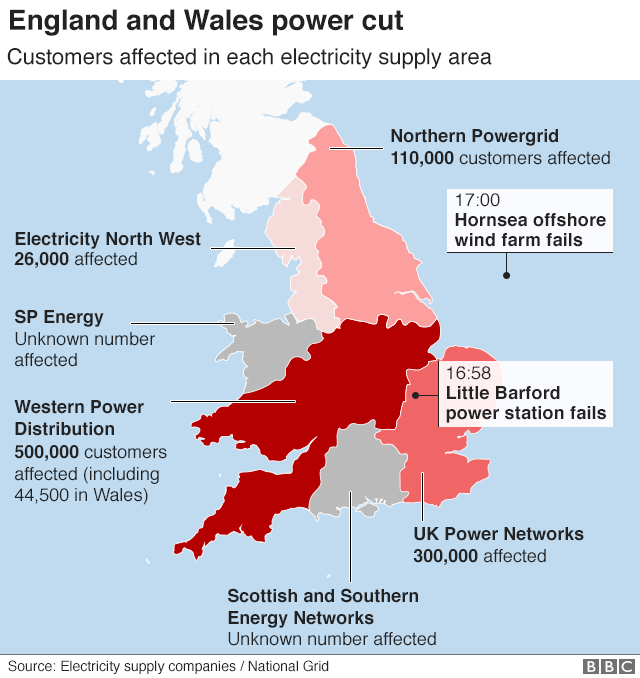

Last week, a rare but significant event occurred in the United Kingdom when a minor glitch at a national grid substation plunged hundreds of thousands of Britons into darkness and caused chaos throughout UK transportation networks.

Although unusual for the UK, such an occurrence could be exactly what it appears to be, or it could signify a larger problem.

Nevertheless, at every juncture in life and business, we have the opportunity to stop, examine, question, and propose new and better ways to (in this case) manage the UK grid and just because the UK electrical grid has evolved into what it is today, it doesn’t mean that it must remain that way indefinitely.

In fact, odd things can happen when anything is allowed to simply ‘evolve’ without an overriding vision to guide it. Besides the UK electrical grid, some examples of this are: the platypus (a funny-looking but diligent burrowing animal), the roadrunner (a comical-looking bird that can’t fly and seems to spend most of its time running beside cars on the freeway), and er, well, communism.

Yes! Things can evolve unpredictably and that’s why some animals and dinosaurs have become extinct over the eons.

Random genetic mutation can only get you so far without an overriding vision to get you past the challenging parts.

It turns out that the Little Barford power station failed, and so the national grid wouldn’t be overloaded, the Hornsea offshore wind farm curtailed its power delivery to the UK until the problem was fixed.

Creating an Electricity Grid for the 21st-century: Clean, ‘Islanded’ and Locally-Owned

No one in their right mind would’ve created the UK energy grid the way it presently sits were an intelligent species to land on Earth some 5000-years ago and begin to populate the landmass we now call the UK.

Major cities would’ve been located far inland near mountains and large water sources, not where they are located now.

Port cities would’ve been located far upriver with ease of defence in mind — not with the cannons of the Spanish Armada in mind. (The maximum range of Spanish Armada cannons were less than a mile which is why the UK’s present port cities sit about one mile back from the breakwater barrier)

All Britons would’ve served 2-years in the military after completing their academic schooling so they could instantly assist in the defence of the realm any time it was threatened from the sea or air.

And most of all, the UK wouldn’t have built humongous power plants with thousands of miles of powerlines and pylons crisscrossing the island if they wanted the highest level of security for the UK’s energy infrastructure.

Alas, these things evolved instead of being overseen by an intelligent designer with deep knowledge in regards to helping nation-states add energy security to the network.

From a security standpoint, using the OBF model is practically asking your enemies to bomb your power plants.

The OBF, or ‘One Big Factory’ model is what the former Soviet Union employed for factories — which was extremely efficient from the ‘economies of scale’ perspective — but was horribly flawed from the security perspective, as one bomb could destroy the country’s entire tractor production, or entire automobile production, or entire footwear production, etc., for a decade or longer.

In short, when economists design your economy, you build one gigantic factory to produce tractors (for example) to assist in the ‘economies of scale’ and to simplify the distribution system (all good there!) but it allows the possibility that an enemy could destroy your country’s entire tractor production with one bomb.

Or one bomb per year, should you ever decide to rebuild the facility, because that’s about how long it would take to rebuild after a successful attack.

Alarmingly, this is the model the UK has employed over past decades in relation to Britain’s electricity grid.

Nuclear power plants located close to the ocean, easy-to-access hydroelectric dams, large coal-fired power plants with a wire fence that can barely keep curious dogs out, and large natural gas power plants are easily found and accessed by anyone visiting or living in the UK — and all of them are huge and tempting targets in time of war or terrorism. Dangerously so.

No one person or group is responsible for this concerning state of affairs. The situation has ‘evolved’ instead of being led by security professionals and by the people tasked to defend the UK — the police, the security services, and profoundly, the UK military. To those folks, thank you again for protecting the United Kingdom.

It does no good to affix blame nor to scoff at energy experts. Since 1933 when the UK’s first electrical grid came online (on-time and on-budget!) utility companies have done exactly as instructed by government regulators. And it was all good, in its time. But that was then and this is now.

I’m saying that the present energy grid has evolved logically — but now needs to be ‘hardened’ — that is, to be made more secure and be made to be easier to secure.

A non-OBF model, if you take my meaning.

More, and Smaller, Power Producers Placed Closer to Demand Centres

Instead of OBF-model power plants located hundreds of miles away from demand centres complete with thousands of miles of hideously-expensive powerlines and pylons transferring energy across the UK, what the country needs is many, smaller power producers located nearer to demand centres.

Renewable energy gives us the opportunity to create a brand new energy grid — a decentralized grid — to better serve UK energy consumers.

The case I want to make is that ‘islanding’ electricity grids on a per-county basis is the way to go here, although such grid ‘islands’ are ultimately connected to a national grid for convenience and for failsafe/backup protection thereby allowing electrons to flow uninterrupted to energy consumers during fluctuations in the power supply (from any source).

For just one example of this, in the town of Güssing, Austria, a town that was dying economically, residents got together and decided to become ‘part of the solution instead of part of the problem’ and built a biomass burner that produced electricity — whereupon it suddenly became affordable to pay formerly unemployed residents to collect wood and decades of accumulated waste from the surrounding forest which created dozens of local jobs and initiated a badly needed forest cleanup!

‘Dead-end’ Austrian town blossoms with green energy (New York Times)

So, Let’s Compare Somerset UK, to Güssing Austria

The costs to deliver electricity from disparate power generation facilities located across the UK to Somerset’s 250,000 households 24/7/365 are astronomical. Also, powerline current losses in humid weather over such long distances can result in fugitive energy losses in the tens of per cent. Few or even zero jobs were created for Somerset in meeting the county’s electrical needs. And the thousands of miles of national grid powerlines and pylons required to deliver elecricity to Somerset adds vulnerability to Somerset’s energy paradigm.

Compare that to Güssing, Austria where residents are part-owners in that ‘islanded’ and profitable electrical grid where many residents work directly for the various community-owned power plants, or work indirectly for them by collecting and delivering feedstock to the local biomass facility, or they lease their land to the local grid for solar panel or wind turbine installations, or they gain other benefits (such as dividend cheques) from Güssing’s energy paradigm.

See the difference?

Self-Sufficient (‘Islanded’) Grids for Each UK County

There’s no reason in the world why Somerset couldn’t create its own ‘islanded’ grid sufficient to meet 100 per cent of the maximum demand of Somerset and reap the rewards thereof. Jobs! Jobs! Jobs! And profits for local Somerset shareholders, especially when that (hypothetical at this point) islanded Somerset grid would have the opportunity to sell surplus electricity to the national grid operator 24/7/365 except for the very coldest winter days when electrical demand hits its maximum annual peak in Somerset.

Be an Owner, Not a Renter!

If you live in Somerset, you might even lease some of your farmland to the Somerset energy co-op so they can install wind turbines on your land (which pays farmers about £4000/yr, per wind turbine) or you could rent the rooftop of your home or business for a solar panel installation.

Or you could own the solar panels yourself and sell your surplus electricity directly to the Somerset grid.

Video: Almost-bankrupt Boulder City, Nevada (now, rich Boulder City!) collects $20 million per year leasing city land to solar power companies (CNN)

In California (admittedly a sunnier location than Somerset, England) some residents are selling approx. $3000. worth of surplus solar energy to their local utility company annually. Under California law, energy companies must ‘square-up’ with homeowners by February 1 of each year or they lose their business licence.

When energy is local, the benefits are too.

How to Produce That Much Energy in Somerset

There are a few jargon words when we talk about energy and you can ignore all of them.

Leave terms like ‘baseload power’, ‘load-following’ power, and ‘peaking power plants’ to the experts. You don’t need to know those terms in order to support a local islanded energy grid based on the community-ownership model.

All you need to know is that it’s been done in many jurisdictions around the world, and that it can be done in your county.

Again, using Somerset as an example, let’s assume that 20,000,000 MWh/yr is the hypothetical grand total of MegaWatt hours of electricity used by all electricity consumers in Somerset County over the course of a year.

All that would need doing in order to ‘island’ Somerset’s grid, is to install a commensurate amount of electrical power generation in the county to meet 100 per cent of Somerset’s peak energy demand which occurs during the highest demand months of December and January.

During the rest of the year when Somerset isn’t using the peak energy demand amount, all surplus electricity generated by the locally-owned and operated Somerset grid could be sold to the national grid operator at the wholesale electricity price, thereby creating profit for Somerset community owners approximately 300-days of the year.

There are some generalities to discuss when setting up such a grid:

- Some regulations might need to be amended to allow cooperative ownership, although this model is currently in use in many countries.

- You’ll want to be an ‘islanded’ grid — yet still connected to the national grid to enhance grid stability in Somerset and in the rest of the UK. If the national grid goes down, an automatic switch would instantaneously flip Somerset back to 100% Somerset grid power only and you wouldn’t realize that the rest of the UK had been plunged into darkness until you read it in the newspaper the next day.

- Energy sold to the national grid would receive only the wholesale rate, not the retail rate. Still, that represents serious export revenue (profit) over the course of a year.

- Somerset could reasonably provide 10% of its electricity demand from burning local biomass. But trucking it in from other counties wouldn’t make economic sense.

- Somerset could install some so-called ‘run-of-river’ power producers — some of which fit inside a water main and produce electricity as water flows downhill through the turbine (or downstream, if the pipe is submerged in a river). See video here: Lucid Energy

- Huge opportunities await farmers and owners of other large properties for wind turbine installations, and at approx. £4000./yr to rent the land for each wind turbine, some farmers might find that ‘growing electricity’ pays better than growing crops. Really. Farmers that sell lots of wind won’t need agricultural subsidies. Ever.

- Reasonable opportunities await those with large rooftops that face the Sun and who are willing to install solar arrays allowing those homeowners to sell their surplus electricity to the community-based grid operator at the wholesale electricity price.

- Wave and tidal power plants could be a massive business for the local Somerset grid and although initial investment costs are high, they’re already doing this in Scotland and Wales.

- Small Combined Cycle Gas Turbine power plants (CCGT) could be placed much closer to demand centres like towns or factories. The smaller the unit is, the easier it is to get site approval for a natural gas CCGT power plant. Small units are a simple modular unit that produce 31 MegaWatts (enough to power approx. 30-thousand homes) and they take up surprisingly little space.

- Natural gas is expensive, so CCGT burners switch-on only when demand can’t be met by all the other producers on that grid working together, yet CCGT turbines are the most important part of any grid, islanded or not.

- Only natural gas generation can produce instant, on-demand power to deal with the frequent demand spikes during the day and General Electric (for example) has CCGT models that arrive in a shipping container and are instantly ready to produce electricity once you connect the gas and attach them to the grid. See short video here: GE TM2500 Gas Turbine. Impressive! This is called a ‘peaking power plant’ as it supplies huge blocks of power to the grid only during peak daytime demand, or when another electricity producer is offline for a few hours or days due to maintenance or unforeseen incident.

- Further, total CCGT capacity needs to be 20% of total islanded grid capacity. That’s not to say the CCGT will be running all day. Some CCGT units switch-on for as little as one hour per day to meet the sudden increase in electricity demand around suppertime. Demand spikes can be big and sudden, or small and intermittent, and you need the ability to instantly and automatically ramp-up electricity generation to meet those demand bursts. And only CCGT can do that. OK, burning oil can do that too, but it’s environmentally wrong.

- If Somerset employed a number of small coal-fired burners but limited their output to less than 2.5% of Somerset’s maximum islanded grid capacity, the county would still meet their per capita Paris Accord emission targets. Easily.

- Some amount of storage capacity is a must for all grids, especially in the ‘island’ grid scenario. In Scotland, hydroelectric dams store energy and create electricity by directing water to fall through spinning turbines in the normal way, but some of that water is pumped back up to the reservoir at night when electricity rates are low to be run through the turbine again the next day. This process is called ‘pumped storage‘.

- As Somerset has no major hydroelectric dams, it would need a giant battery such as the TESLA mega battery recently installed in Australia to help regulate energy flows and stabilize the grid. See: Tesla’s Record-Breaking Mega Battery Saves Australia $40 Million in Its First Year

Now that’s an energy future that could work for every county in the UK and provide opportunities to dispatch clean energy to other counties on an as-needed basis, thereby allowing Somerset’s grid ownership group to profit on every kilowatt dispatched, but also retain their ability to export massive blocks of clean renewable energy through the existing national grid operator infrastructure to the Republic of Ireland and the European continent in exchange for cold, hard, cash. (Thank you, national grid operator!)

Which should be the primary goal of the UK national grid operator anyway — managing electron flows between the UK’s (then) self-sufficient county grids, and to manage the (then) profitable energy exports to the continent and the Republic of Ireland.

9-Point Plan to Meet the UK’s COP22 Clean Air Commitments by 2022

- Coal generation to meet 2.5% (or less) of total UK demand.

- Biomass generation to meet 7.5% (or less) of total UK demand.

- Natural Gas generation to meet 20% (or less) of total UK demand.

- Nuclear power generation to meet 10% (or less) of total UK demand.

- Hydropower generation to meet 2.5% of total UK demand up from .5%.

- Pumped Storage generation to meet 2.5% of total UK demand, up from .5%.

- Wind power generation to meet 40% of total UK demand, up from 2019’s 20%.

- Solar power generation to meet 15% of total UK demand, up from 2019’s 5%.

- Mega Battery installations sufficient to stabilize the entire UK electricity grid.

Notes

A) Before coal, natural gas & nuclear generation can be decreased, renewable energy additions must be fully online before they can help to meet total UK demand.

B) Lower CO2 emissions via a 30% decrease in non-renewable energy generation compared to 2019.

C) Lower CO2 emissions via a 34% increase in renewable energy generation compared to 2019.

D) Mega-Battery installations sized appropriate to each UK county grid.

E) Surplus UK generation would be exported as electricity or hydrogen.

Benefits of Moving to an 85% Renewable Energy Grid by 2022

All of this necessary change would increase Britain’s GDP, help the UK environment, it would allow the community-based owners of county grids to lower their own energy costs and earn profit by supplementing other county grids and by exporting clean energy. And even non-owner Britons will enjoy lower electricity prices in a more secure primary energy paradigm.

Related Information

- Want realtime energy information on the UK grid? (GridWatch.co.uk)

- UK power cut: National Grid promises to learn lessons from blackout (BBC)

- How Utility Companies Select from a Myriad of Power Producers in Realtime (LetterToBritain.com)

The UK Grows its Economy as it Replaces Coal with Renewable Energy

Great Britain has come a long way since the Industrial Revolution when it was almost completely dependent on coal.

The snapshot in time (below) covers the period May 1, 2019 through May 8, 2019 showing which energy producers contributed to the UK national energy grid and how much they contributed.

But in 2018, the UK met total electrical demand with 5% coal, 19.5% nuclear, 33.3% renewable energy and 39.4% natural gas. 2019 looks set to be even better from a clean air perspective. Burning coal to meet UK energy demand might reach 1% in 2019.

Every month, more wind turbines are installed and connected to the UK grid. About half of them are installed offshore (out of sight and out of mind) where they produce almost constant power 24/7/365 and are shut down only one day per year for inspection.

The other half get installed in farmers fields where they add energy to the grid day and night. Farmers like this arrangement because it adds to their bottom line as the utility companies rent the land upon which the wind turbines sit.

For example, if a farmer has one wind turbine mounted on his property, he or she will receive approximately £4000. per year from the utility company — but if the farmer has 20 wind turbines on his or her land, he or she will receive £80,000. per year for the land lease and 24-hour-per-day access rights.

In the case of larger farms, this amount could equal his/her annual spend on seeds, or in the case of ranchers, it could meet their annual veterinarian bill plus whatever the rancher spends on medicine and other treatment for their animals.

Although not as profitable as offshore wind turbines, having many electricity generators near demand centres is a definite benefit for utility companies.

The moral of this story is, adding one million wind turbines to the UK grid over the next 10-years (half of them onshore) would work to increase the profitability of farmers and ranchers, and could save them from insolvency during years of drought or flooding.

When did coal ever do that for farmers and ranchers? Never!

Wind power generation in the UK theswitch.co.uk

That’s why the UK must commit to adding one million wind turbines over the next 10-years — thereby turning the UK into a major energy exporter to the EU, as the cables to transmit electrical energy are already installed and in use daily to import (expensive) gigawatts of power from the EU annually. See where I’m going here?

Adding half a million onshore wind turbines would dramatically empower farmers and ranchers, most of whom spend their profits close to home; Making land-based wind turbine economics an important force for good in local economies.

Siting those wind turbines so that they don’t trash-up the UK’s Areas of Outstanding Natural Beauty (AONB) will of course be an important consideration going forward.

It’s important to locate the turbines in natural wind corridors, sure, but installing them within sight of Castle Howard for one example, or within sight of major residential areas is a bad idea no matter how good the wind potential there. Careful siting of wind turbines is a must to… prevent… (wait for it!) ‘blowback’ from NIMBY communities. Hehe.

READ: The UK Has Gone 6 Days Without Burning Coal Now, And Guess What, The World Didn’t End (Science Alert)

The UK Economy Continues to Grow In Spite of the Overly-Extended Brexit Negotiating Period

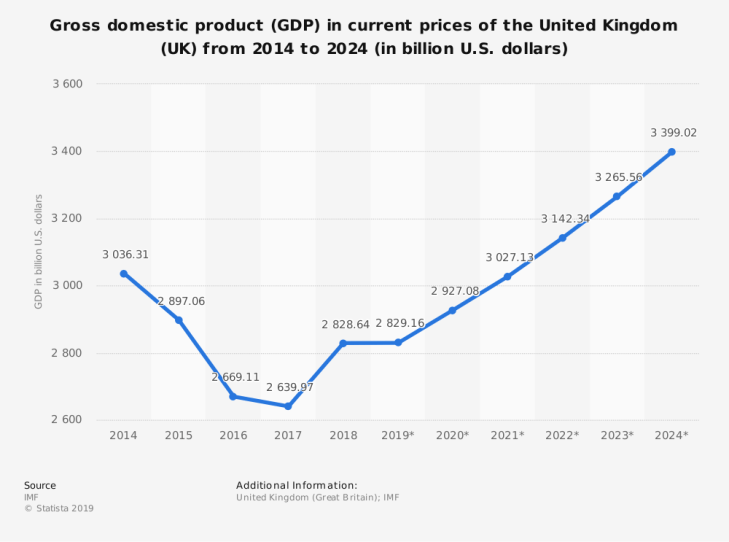

The statistic shows the GDP of the United Kingdom between 2014 and 2018, with projections up until 2024, in US dollars. Image courtesy of Statista.com

Say what you like about Prime Minister Theresa May (or, ‘Theresa the Appeaser’ as she is known to Brexiteers) and Chancellor of the Exchequer Philip Hammond (possibly the most risk-averse man on the planet) they did a good job running the UK economy, although in the end, they couldn’t secure a decent Brexit agreement with the EU; Which is the only reason that both of them are soon gone from their present jobs.

Ultimately, the 3-years of economic uncertainty in the UK caused by the overly-extended Brexit negotiation period prompted the removal of Theresa May from the PM’s chair, and Philip Hammond from the Exchequer’s chair once the next PM is chosen.

But imagine how the UK economy would’ve accelerated had May and Hammond accepted the ring of destiny handed to them by 17,410,742 UK voters in June 2016.

Still, when you can grow the UK economy while removing coal and adding huge quantities of renewable energy to the grid — right in the middle of Brexit — you’re obviously doing something right.

But The People called for Brexit, and Brexit it will be.

Plan Your Work, Then Work Your Plan!

Someone should thank the best Environment Secretary in Britain’s history for the massive renewable energy capacity addition to the UK grid in recent years in locations where renewable energy does make economic sense, for the astonishing CO2 reductions, and for backing energy conservation programmes that reduced energy costs £2 for each £1 of programme spend.

This is where the UK must continue to focus its greatest efforts. Where its cheaper to install renewable energy, then install renewable energy; Where its cheaper to spend on energy conservation programmes to lessen demand, then spend on conservation; And where its better to locate energy producers near energy demand centres, then locate energy producers nearer demand.

READ: Study: UK leads G7 at cutting emissions and growing economy (BusinessGreen) You must register at their site to read the article. Here’s an excerpt though: “Report shows that in the 25 years since the Rio Earth Summit the UK has delivered the best economic performance and the deepest carbon emission cuts of any G7 state.”

The UK Could Lead the World in Local Clean Air Improvements and Increased Renewable Energy Exports

On a county-by-county basis, replacing coal-fired power generation with natural gas-fired generation supplying 15% of total demand in every UK county, 65% of total demand in every UK county met via wind and solar, and hydropower and biomass covering the remaining 20% of total electricity demand in every UK county… is the fastest way to clean energy, lowered healthcare costs and increased energy exports to the continent, which should be Priority #2 of any UK Prime Minister. (Brexit is Priority #1 for now, and being a democrat, I get that)

But next on any PM’s list after the Brexit item must be growing the UK economy while replacing coal and natural gas via generous energy conservation programmes and massive renewable energy capacity additions.

READ: UK Leads G7 in the Combined Metric of Economic Growth + Carbon Cuts (LetterToBritain)

Let’s hope the UK continues its great track record in lowering CO2 emissions, lowering its annual healthcare spend on respiratory disease, and growing the economy.

The only component missing in the UK’s clean air goals are the mind-boggling opportunities that await UK energy producers to export gigawatts of renewable energy to the EU in exchange for billions of euros annually.

Bonus Graphic

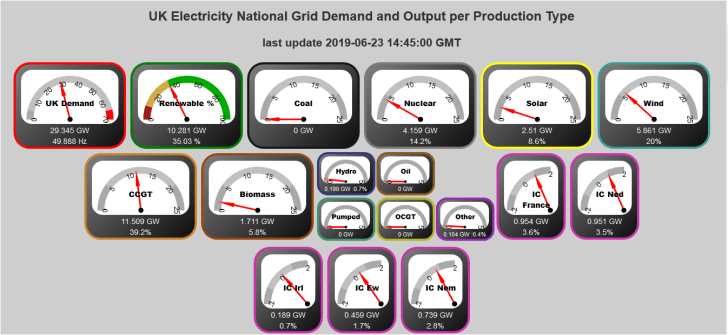

Here’s a great resource where you can track in realtime, how much energy the UK is purchasing from the EU.

When the snapshot was taken, the UK national grid was purchasing 3.3 gigawatts of energy from France, the Netherlands, the Republic of Ireland, and other EU energy producers.

Snapshot of UK electricity demand on June 23, 2019 at 2:45pm. Click the image to access the realtime dashboard at any time.

Keep in mind that 14.70 pence per kWh is the average cost for electricity in the UK. So, yes, UK energy consumers spend billions to purchase electricity from EU utility companies annually — instead of EU utility companies purchasing billions worth of electricity from UK utility companies annually. Facepalm!

Notes:

- One Gigawatt (GW) is equal to one million kilowatts (kW)

- One MegaWatt (MW) is equal to one thousand kilowatts (kW)

For More Information

The U.K. Cut Emissions to the Lowest Level Since 1888. Here’s How (Fortune)

What will it take for the UK to reach net zero emissions? (The Guardian)

Floating wind farms just became a serious business (Quartz)

Fossil Fuel Subsidies ‘Bad for Business’ Say $2.8 Trillion Investor Group

by John Brian Shannon

Originally posted at kleef.asia

In advance of the G20 Hamburg Summit in July 2017 investor groups that control $2.8 trillion in assets report that fossil fuel subsidies are counterproductive to G20 economies.

This latest call to remove fossil fuel subsidies came two years after the G20 Brisbane Summit where leaders announced their intention to, “reaffirm our commitment to rationalise and phase out inefficient fossil fuel subsidies that encourage wasteful consumption.” — G20 Brisbane Leaders’ Communiqué (November 2014, Item #18)

The 16-member mega-investor group says G20 nations should set a clear timeline “for the full and equitable phase-out by all G20 members of all fossil fuel subsidies by 2020,” and mobilize “to accelerate green investment and reduce climate risk” in a report submitted to G20 foreign ministers preparing for the upcoming G20 Summit in Hamburg, Germany.

G20 fossil fuel subsidies total $452 billion a year according to the Overseas Development Institute and Oil Change International.

A Must Read: Empty promises:

G20 subsidies to oil, gas and coal production

Meanwhile, annual subsidies for renewable energy in the G20 nations amounts to only 1/4 of the annual subsidy awarded to fossil fuels, which have received mega-billions of subsidy dollars every single year since 1918.

Annual G20 Fossil Fuel Subsidies = $452 billion. Renewable Energy Subsidies = $121 billion (2015)

For the next few paragraphs, let’s look at the United States exclusively…

1918-2009 Fossil Fuel Subsidies vs. Renewable Energy Subsidies in the U.S. The Historical Role of Federal Subsidies in Shaping America’s Energy Future: What Would Jefferson Do?

The average annual subsidy for Oil and Gas alone in the U.S. from 1918-2009 totals $4.86 billion.

Adding all those (oil and gas only) subsidy years together gets you the astonishing figure of $442,260,000,000. in total from 1918-2009 — that’s half a trillion dollars right there, folks.

Which doesn’t include wars to protect foreign oil exporters to the United States.

Nor does it include so-called ‘externalities’ which are the negative costs associated with the burning of oil and gas — such as the 200,000 annual premature deaths in the U.S. caused by airborne pollution, along with the other healthcare costs associated with air pollution, the environmental costs to farmers and to the aquatic life in our rivers and marine zones, and higher infrastructure (maintenance) costs.

Fossil Fuel Subsidies chart from DBL Investors What Would Jefferson Do? which shows the capital gains allowance (a type of subsidy) enjoyed by the U.S. coal industry that totals $1.3 billion over the 2000-2009 timeframe.

This chart shows only the U.S. capital gains allowance! There are other coal subsidies, direct and indirect, at play in America — in addition to the externality costs of coal.

On the Externality Cost of Coal

Harvard Medicine

Each stage in the life cycle of coal—extraction, transport, processing, and combustion—generates a waste stream and carries multiple hazards for health and the environment. These costs are external to the coal industry and are thus often considered “externalities.”

We estimate that the life cycle effects of coal and the waste stream generated are costing the U.S. public… over half a trillion dollars annually.

Many of these so-called externalities are, moreover, cumulative.

Accounting for the damages conservatively doubles to triples the price of electricity from coal per kWh generated, making wind, solar, and other forms of non-fossil fuel power generation, along with investments in efficiency and electricity conservation methods, economically competitive. — Full Cost Accounting for the Life Cycle of Coal (Harvard Medicine)

Fossil Fuels = High Subsidy Costs, High Externality Costs and Lower Employment: When Compared to Renewable Energy

In addition to the direct and indirect subsidy costs of fossil fuels, there are the externality costs associated with carbon fuels, but almost more important, is the ‘lost opportunity cost’ of the carbon economy.

Over many decades in the U.S., conventional energy producers have tapered their labour costs to only a few persons per barrel of oil equivalent (BOE) while renewable energy hires more workers per BOE, which will result in a significant net gain for the U.S. economy.

You will find more statistics at Statista

You will find more statistics at Statista

Even with the paltry subsidy regimes presently in place for U.S. renewable energy in the year 2017 — once fossil fuel subsidy costs, the externality costs of fossil fuels, and the ‘missed opportunity’ costs (fewer jobs per BOE) are factored-in to the equation, renewable energy really begins to shine.

And best of all — by 2020 and without any subsidies (yes, really!) renewable energy will regularly beat highly subsidized conventional energy generators at their own game — by lowering electricity costs, by lowering healthcare and infrastructure costs, and by creating thousands of new, good-paying jobs.

Who was saying that renewable energy was a pipe-dream?

Bonus Video: