Home » Posts tagged 'British Economy' (Page 2)

Tag Archives: British Economy

Choosing Triumph or Tragedy for Britain’s Economy

by John Brian Shannon | November 21, 2016

In this new century every country has its challenges. And these days, even advanced nations like Britain are challenged to balance the books while still providing the services that citizens depend on, and international partners expect.

No Worries. It’s easy as pie!

But we’ll get to the pie charts later. For now, let’s sketch out some broad outlines that a vast majority of people probably agree on.

And number one on the list must be that rich countries shouldn’t be running budget deficits. Ever. With the possible exception of major national emergencies or God-forbid, another World War. Other than those caveats, there is simply no excuse good enough that G7 nations should be running budget deficits. Full stop.

Ours is the most advanced civilization the world has ever known, we are literally swamped in knowledge and technology, and our ability to communicate and trade with other nations is almost limitless.

Why then, do developed nations have budget deficits that have piled-up over the decades to the extent that some nations have debt levels approaching 260% of GDP? (NOTE: Government debt is merely the total of their accumulated deficits)

It’s a very good question and the answer is; WWI, WWII, the Cold War, assorted other wars like Vietnam, the 1990 Gulf War, the Iraq War and the Afghanistan War — all of these required massive spending on a buy-now/pay-later basis.

For one example of how costly this is, the total interest payments just to service U.S. government debt since deficit spending began, equals $2.5 trillion dollars.

Here are the highlights from the U.S. Debt Clock (courtesy of the U.S. Treasury)

- U.S. total national debt — $19.8 trillion

- U.S. debt per citizen — $61,131

- U.S. debt per taxpayer — $166,240

- U.S. budget deficit — $590 billion (when calculated using GAAP rules, this number totals $5.6 trillion)

America alone spent one trillion dollars on the Iraq War.

For one trillion dollars (from the year 2000 through the year 2050) every unemployed American citizen could have been given a job paying them $50,000/year for their entire working life, and each kid who couldn’t afford to pay their university tuition themselves could have gotten one baccalaureate degree paid for by the U.S. government, and each U.S. citizen living on welfare could have been paid $25,000/yr to keep the mailboxes on their street clean and painted, and the sidewalk swept. With quite a few billion dollars left over by the time 2050 rolled around.

Instead, all of the money spent on war by the United States was borrowed money that will never be paid off — and American citizens will be paying the interest indefinitely. Forever is a long time.

See this snapshot on U.S. government debt. Scared yet?

For comparison purposes, the population of the United Kingdom is almost exactly one-fifth of the United States. Below is a snapshot of Britain’s deficit and debt picture.

- Britain’s total national debt — £1.7 trillion

- Britain’s debt per citizen — £28,589

- Britain’s debt per taxpayer — £49,174

- Britain’s budget deficit — £19.1 billion

Britain – Government expenditures for Fiscal Year 2017

At the moment, the UK government is doing three things well to help Britain’s economy

The brightest spot for Britain’s economy is the already-passed legislation requiring that all central government budgets be balanced from 2020-onward.

Another hopeful sign is that Philip Hammond, Chancellor of the Exchequer, has devoted £1.3 billion to a road building plan in his recent Autumn Statement, thereby allowing thousands of workers to continue working, and adding hundreds of presently unemployed workers to the workforce.

In the creative accounting department, workers can now save some money and their employers can save even more — while both avoid some amount of National Insurance cost compared to the existing calculation method, via the so-called ‘Salary Sacrifice’ method.

Britain – Chancellor of the Exchequer Philip Hammond does a bit of magical accounting (the good kind) to make British tax law more efficient. Click on the image to read the Daily Mail article.

While these seem to be small (but brilliant) improvements to the UK economy, it’s important to remember that the Theresa May government is less than 130 days old. And although these are baby steps, they are positive and add certainty to Britain’s economic outlook.

More fiscal and monetary levers need to be applied than that however. And importantly, countercyclical policy must be employed as a long-term economic lever throughout the British economy, with special emphasis on creating employment during economic downturns.

What else could be done to help Britain’s economy?

Quite a lot.

Every government in the world needs money to operate, and the taxes gained from personal income tax are already too high (just ask any taxpayer) while higher corporate taxes are detrimental to attracting business to your country.

Four quick ways to supercharge Britain’s economy

a) Match Canada’s lowest-among-the-G7 corporate tax rate

b) A 5% tariff on every imported good

c) Massive infrastructure spending programme equal to annual import tariff revenue

d) Legislation permitting up to 5% of electrical demand in each UK county be met with clean coal

Still bound by EU trade laws over the next (approx) 36 months, how can Britain excel economically?

a) One of the reasons that Canada virtually breezed-through the financial crisis of 2009-2012 is that it had the lowest corporate tax rate in the developed world, it ranks well for ease of doing business, and it has a streamlined process for existing businesses to relocate to Canada allowing corporations to easily move to a lower corporate tax rate — all of which worked to keep Canada on an even keel throughout the global financial crisis. (Not world-changing, but ‘just enough’ to get the job done for Canada)

In retrospect, during the boom times, a low Canadian corporate tax rate represented a slight loss in revenue for Canada, but during the recession the low corporate tax rate promoted many relocations to Canada — when they weren’t prevented by President Obama, that is.

In the case of the Burger King fast food chain, it decided to relocate to Canada in order to save billions in corporate taxes, however, the U.S. President decided to block the move. Although I’m still a fan of President Obama, it teaches us that there are very real limits to the benefits of low corporate taxes, due to market interference by politicians that say they believe in free markets, but don’t. And there are many of those.

Still, a low corporate tax rate that matches the Canadian rate would attract new business to Britain. There will be times that such moves are overruled by faux free trade governments, but on the main, Britain would gain more than it would lose by matching Canada’s corporate tax rate.

Yes, the UK government would lose some amount of corporate tax revenue in the short-term. However, that is balanced-off by the hundreds of new businesses that would relocate to Britain over the long-term — possibly even from Canada which can’t compete with the astronomical level of economic activity in London, nor a prestigious London address.

Inclusive in the term free enterprise with free markets, means that corporations are free to set their headquarters anywhere they want.

Where to recapture that corporate tax revenue loss and add billions more revenue?

b) The most efficient way for Britain to recover that short-term revenue loss and to gain billions more revenue, is by instituting a 5% tariff on every good that arrives in the country.

If Britain and her trade partners agree to the same 5% tariff and a standardized list of exemptions in their own countries, there will be nothing to fight over.

On a personal note, because I happen to believe that knowledge is the solution to all problems, I have a problem with taxes on books, whether they are books printed on paper, recorded on DVD’s, or are purchased as E-books.

Similar applies to those medicines that save lives. Such things should be exempted from all forms of taxation, including tariffs. Everywhere on the planet.

By instituting a nominal tariff of 5% Britain would also make imported products minimally more expensive, while Made in Britain products would become more cost-competitive. British manufacturing (jobs) would see an uptick and sales (profits) would increase.

NOTE: Not to make this too complicated here, but many of Britain’s exports are high-end items. If there happens to be a 5% tariff placed on British goods in other countries, don’t expect it to stop foreign buyers from purchasing an Aston Martin, for example.

At the other end of the market, low-end items such as imported T-shirts which typically sell for £1.40 will not be much affected by a 5% tariff. However, it would be reasonable to expect an uptick in the sales of UK manufactured T-shirts. (In a perfectly efficient UK T-shirt market, a 5% sales increase in UK manufactured T-shirts could be expected once the foreign manufactured T-shirt inventory is sold off)

Obviously, both the pricey and the least pricey items wouldn’t be much affected by a 5% tariff (for very different reasons) but foreign manufactured items in the middle price ranges will be the items affected, and the market would see a corresponding rise in the sales of UK manufactured items. Things like computer monitors, home exercise equipment, and food processors, for example.

A 5% tariff would raise uncountable billions of pounds sterling for the British government — exactly in the time of deficit elimination, and as unprecedented immigration levels have increased unemployment among blue-collar workers in Britain, and as Brexit roils the markets, and as a potentially protectionist U.S. administration is crowned.

In short, there is every reason for Chancellor of the Exchequer, Philip Hammond, to create a minimal and standardized tariff structure (that all of Britain’s trade partners could buy-into) means that it could be passed immediately if EU parties agree thereto. Otherwise, it can’t begin to take effect until the day after Brexit occurs.

Even so, there’s no reason that the legislation couldn’t be researched and written now, ready for Day One of post-Brexit Britain.

I can’t emphasize it enough. The Chancellor of the Exchequer and the Prime Minister must SELL their trade partners on this tariff, proving that it will be a net benefit to all of Britain’s trade partners. (If a mild tariff can do all that for Britain’s economy, it can do the same for EU nation economies)

In the absence of convincing EU trade partners of the wisdom of this plan, three years of tariff revenue will be lost — revenue that could have been used to dramatic effect in the UK economy.

c) While Philip Hammond’s £1.3 billion road building plan is a good one, it needs to be upgraded to a £130 billion national infrastructure plan.

So much of Britain’s infrastructure — from roads and bridges, to trains and trams, to airports and seaports, and to significant other structures and buildings — need replacement, repair, or major upgrades.

It could even save money over the long-term. In the case of many of Britain’s old government buildings, due to their obscene electricity consumption and inefficient insulation, some old buildings cost millions of pounds per month to light and heat.

Building new, Zero Net Buildings, means that they produce as much energy as they consume over the course of the year, saving millions of pounds sterling annually.

Retrofitting older structures isn’t quite as efficient, yet can still save millions of pounds annually.

Millions of British jobs would be created over 10-years and all of it paid for by a tariff on imported goods.

(Yes China, the U.S., and other UK trade partners, please export more stuff to Britain, as we need the tariff revenue!)

The tariff could easily provide enough funding to accomplish all of this and more, once Britain is running balanced budgets.

d) Legislation that permits up to 5% of electricity demand *in each UK county* be met with clean coal, means return to employment for thousands of coal miners, it means the construction of hundreds of small, clean-coal power stations, and it means that an amount of reliable and cheap electricity equal to the demand of all government buildings is sourced, produced, and sold — in Britain, for Britain, and by Britons.

Allowing 5% of demand per county to be met with clean coal power stations ensures that the country can stay on track to meet its international CO2 commitments and avoid the negative healthcare costs associated with behemoth scale coal power stations located near major population centres.

These are simple ways to attract new business to Britain, to increase revenue for a government still on the mend from the global recession, to create jobs and increase profits for the construction, manufacturing, and coal mining and coal-fired generation segments of the economy, and to add much-needed stability to the UK energy grid.

Instead of waiting to do it all after Brexit — and who knows what might happen to the global economy in the meantime — it’s better to take Britain out of its economic shackles, now, proactively, and with vigour.

The Chancellor of the Exchequer, Philip Hammond, has made some deft moves in recent days. Let’s hope this is the beginning and not the end of this trend.

Related Links:

Brexit, and now, Trump. What’s driving voters to reject the status quo?

by John Brian Shannon | November 14, 2016

After eight years of competent and relaxed rule by President Barack Obama, real estate tycoon Donald Trump arrived on the scene and swept Democrats and other Republicans aside to win the presidency of the United States. So obviously a protest vote — but a protest against what?

Pollsters and so-called ‘elites’ seem astonished at the Trump victory yet many saw it coming from afar. How is it that some people ‘never saw it coming’ while others saw it as a logical progression of the present societal moment?

The U.S.A. has a total population of 325 million people (November 2016) and when we look at the demographics of the country by quintiles, we see that there are five groups of 65 million people.

Each group is ‘one quintile’. The ‘top quintile’ are those who are the top income earners in the country, while the ‘bottom quintile’ are the lowest income earners in the country, etc.

The so-called ‘elites’ live in sumptuous luxury that few can imagine and tend to have stable lives which is a direct consequence of their high income levels and (usually) higher level of education.

Ninety-four percent of the people who live in the top-two quintiles are children of parents who also lived in the top-two quintiles.

(Yes Virginia, wealth is largely inherited and many studies attest to this — the myth of ‘work hard and you’ll get ahead’ represents only six-percent of the top-two quintile population in Western nations)

The bottom-three quintiles in America have been losing ground since the 1970’s when one person (the ‘breadwinner’ of the family) was able to earn enough to support a family, buy a reasonable home, and a new car every 2-3 years without needing to finance the purchase, take one vacation per year, and send their kids to college. All on the strength of one income-earner!

Nowadays, the bottom quintiles are barely working, many of their jobs off-shored to Asia. For those fortunate enough to have a job, it takes two income-earners to rent or buy a condo, buying a car means financing it for up to 8-years, and one ‘staycation’ per year (staying near home during vacations, with only daytrips to nearby sights) while their kids must obtain expensive student loans that can take decades to pay off.

It’s a different world from the 1960’s and 1970’s.

The major reason for this is the Reagan-era tax cuts that were designed to stimulate growth and investment in the U.S. economy (which were the right prescription for the times) and those tax cuts created a record number of billionaires — which eventually resulted in the creation of the so-called ‘1 percent’ who now invest their money in the ‘Asian Tiger’ economies which bring better financial rewards for those investors, but results in the off-shoring of millions of jobs in the Western nations.

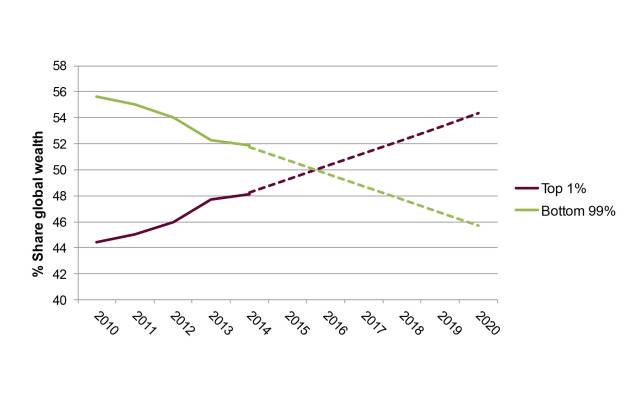

At present, the 1 percent own more than 50% of the world’s total wealth. Leaving less than one-half of the world’s wealth for the remaining 7.3 billion people.

But by 2030, the 1 percent will own more than 75% of the world’s total wealth. Leaving only one-quarter of the world’s wealth for the (then) 8 billion people on the Earth.

And in 2040, the 1 percent will own more than 85% of the world’s total wealth. Leaving only one-sixth of the world’s wealth for the (then) 8.75 billion people to fight over.

World Wars have been waged over less!

Brexit, and now, Trump. Share of the world’s total wealth for the Top 1 percent and the Bottom 99 percent. Image courtesy of OXFAM.

People wrongly blame ‘Globalization’ for this sorry state of affairs but it was a profound change in U.S. tax laws that allowed wealth to flow upward to the 1 percent who simply take their money and invest it in Asia. It represents trillions of dollars (U.S. and Canada) and trillions of euros (EU) and hundreds of billions of pounds sterling that will never, ever, return. It’s money that has left the West forever.

And some people wonder why things like Brexit and the stunning repudiation of the status quo candidate in the U.S.A. (Hillary Clinton) have occurred? Really? Are you kidding me?

Politicians and so-called ‘elites’ who didn’t see this coming have no business leading nations, nor should they be calling themselves ‘elites’ — nor have they ever spent a minute talking with a member of the bottom three quintiles in any Western nation.

In democratic societies ‘The People’ are always right. Some 52% of Britons voted to leave the EU, hoping for a better democracy and a better economy, while in the U.S.A. millions of voters chose hope over the status quo.

Upcoming elections in Italy, the Netherlands, France, and other Western nations are likely to show similar results.

It’s startlingly clear. ‘The People’ aren’t looking for more of the same. They voted for real change — not talk about change!

Politicians like PM Theresa May and President-elect Donald Trump have garnered a huge mandate for change. For politicians, it doesn’t get any better than this. Whatever these politicians do as long as it looks like they’re attempting to meet the needs of ‘The People’ they will be generously rewarded for their successes and easily forgiven if a particular policy fails to meet expectations.

It’s a time of unprecedented opportunity for politicians who’ve upset status quo candidates, but failure to deliver meaningful change now will bring us uncomfortably close to a total breakdown of the social contract that has worked so well for citizens and governments in the postwar era.

For those politicians elected to bring change, but who subsequently fail to do so, will find themselves losing landslide elections four years on — while bringing the wrath of ‘The People’ against ‘The Establishment’.

Let us do our part to make it easy for newly-elected politicians to do the right thing, and to forgive them easily if perchance some minor policy point goes awry.

We all need to do our part to assist the change that must now occur — otherwise, by 2040, some 8.5 billion people will be fighting over 15% of the world’s total wealth — resulting in an apocalypse worse than anything we’ve yet seen.

Related Articles:

The Synergy of Quintile Economics

by John Brian Shannon | November 1, 2016

How Britain could use Quintile economics (Q-economics) to Build a Better Britain

In 2016, the population of the United Kingdom is sixty-five million people. When we divide the UK population into five equal parts, we see that we have five groups of thirteen million citizens. (65,000,000 / 5 = 13,000,000)

Let’s do as the economists and call each group of thirteen million people, one distinct economic quintile.

In the economic quintile system, each group is further classified by annual income, with the top thirteen million listed as the top fifth of income earners in the country, while the bottom thirteen million are listed as the lowest income earners, etc.

We see in the chart below how the various quintiles fare in regards to original income (wages), final income (wages + tax credits + investment income), and the all-important disposable income

The Synergy of Quintile Economics in the UK. Image courtesy of the UK Office of National Statistics.

Clearly, the top two quintiles are in no economic distress, contributing significantly to their own lives and to the overall UK economy.

The top two quintiles are also known for paying their fair share in every way except for their inordinately high CO2 emission levels (larger homes, more vehicles per person with much-poorer fuel economy, and frequent air travel) and the cost of policing and security for higher income earners is much higher per capita compared to the other quintiles.

Yet, it works for those fortunate enough to be in (or born into) the top two quintiles and it works for Britain’s economy.

When we look at the third quintile group incomes of £26,669 (original income) £33,758 (final income) and £25,833 (disposable income) economists see a healthy middle income group — even when measured against other developed nation third quintiles.

Thus far, we have three groups of thirteen million people that (at least, economically-speaking) are faring well in a developed nation economy. Each of those thirty-nine million people are either holding steady or improving their economic position, and one would like to think that they are doing the same in regards to their overall life satisfaction. All of those people (with the exception of CO2 emission levels) are paying their way and are no drain on the UK economy. So far, so good!

The second quintile numbers are challenging. With group incomes of £13,462 (original income) £22,337 (final income) and £19,251 (disposable income) this group is definitely suffering, often face unemployment or are permanently unemployed due to the offshoring of manufacturing jobs — a process which began in the 1980’s. These people through no fault of their own and probably doing their best to succeed in life, simply haven’t had the opportunity, nor (perhaps) the higher education to allow them to join the higher economic quintiles.

In the end, they probably contribute as much as they take from the UK economy. And their overall life satisfaction is likely to be low. The first and second quintiles are also the most vocal and unlikely to vote for incumbent politicians.

Finally, we get to discuss the bottom quintile group with group incomes of £6146 (original income) £13,841 (final income) and £11,883 (disposable income)

Either because of young age/entry-level work or part-time work, or diminishing opportunities in their chosen career, or poor opportunities for higher education in their younger years (in the case of older members of this group) this quintile suffers from low income, much poorer health, poorer housing, and lower life satisfaction index scores. They also die younger, spend more time in hospitals, and as a quintile have more dealings with police and security agencies. Through no fault of their own (as offshoring of jobs isn’t their fault, nor is increased immigration where lower paying jobs are taken by cheaper labour immigrant workers) this group costs the UK economy billions of pounds sterling every year.

If there were jobs available for the people in the bottom quintile they would take them, and no longer find themselves in the bottom fifth with all the attendant costs to themselves, their families, and to UK society

But the simple fact is, in the UK there are many more people looking for work, than there are jobs available — and this is particularly true since the beginning of the influx of eastern European immigrants and immigrants from other regions.

While the highest income quintile costs UK society via extremely high CO2 emissions and policing and security costs — the lowest quintile costs the UK via higher healthcare, crime, policing and incarceration, and social welfare programme spending.

And much worse than all of that, is the lost opportunity that these people represent for themselves and for the UK. This group also has (by far) the lowest life satisfaction levels and the highest suicide rate of all the quintiles. Yet, little is being done to resolve this poorly-understood strata of UK society.

There are three well understood paths to help the bottom-two quintiles (which applies in all developed nations, not only in the UK) which I can briefly touch on here:

- Short term: So-called ‘Helicopter Money’ where the government simply provides more money to the lowest economic quintile. It’s true, the money must come from somewhere and such spending is often resented by taxpayers who themselves, may have benefited from a better education, or inherited money, or both. However, whether £200 billion (for example) is spent on the social costs that are directly attributable to poverty (a combination of social welfare payments, higher healthcare costs, crime, policing/incarceration, and ‘other’ costs) or whether it is spent on helicopter money — it still totals £200 billion! Although, spending on Helicopter Money would have the added benefit of dramatically reducing poverty-induced homelessness, drug addiction, healthcare, healthcare wait times for all healthcare users, crime against persons and property, while insurance rates would fall and the UK would see a lower suicide rate due to higher life satisfaction levels among those in the bottom two quintiles.

- Middle term: Job retraining. Although it’s true that there are many more job-seekers in Britain than there are jobs available, some people that are willing and physically able to work will choose independence from social welfare programmes and thereby increase their personal income and life satisfaction. In a time of increasing unemployment, job retraining programmes are of little value. However, during a time of increasing employment, job retraining programmes score a triple-win — with lower unemployment insurance spending and lower social welfare spending, as retrained people are working and contributing to society, paying taxes, and supporting their own families — instead of being homeless, committing crimes and ending up in the hospital, prison, or both.

- Long term: Many countries now provide ‘one tuition-free university degree’ to each citizen. Each additional degree must then be paid for by the student, or by a sponsor. Norway, Sweden, Denmark, Finland, Germany, France, Switzerland, Austria, Chile, and others, have various programmes whereby citizens can obtain one or more university degrees with no tuition cost for students. Notably, these countries have higher life satisfaction and boast much lower crime statistics when compared to similar developed nations without tuition-free university opportunities. In the United States, those who sign-up for military service under the ROTC programme gain one free college degree in addition to receiving valuable military training and post-military job placement assistance. Britain could offer ‘One Free University Degree in exchange for Gap Year Military Service’ allowing students to take a year off from scholastic learning (their Gap Year) and enter military service as a cadet. At the end of that year, they will have tuition equivalent to obtaining one university degree waiting for them at selected colleges or universities in the UK.

Which is best? All three!

If the UK simply increased social welfare spending to £1088. per month, that replaces all other social welfare spending — for unemployed persons over the age of 19, or to top-up the wages of those stuck in low paying full-time or part-time jobs, or to top-up pensioners on low incomes — all of that additional money instantly becomes available to local economies.

People who earn or receive £1088. per month (£1088. per month is a standard anti-poverty metric) do not have the ability to save money in the bank! Every pound sterling would be immediately returned to the local economy every single month; in rent payments, sales at the grocery store, hardware store, pharmacy, etc. — and if a person is looking for employment, at the barber or hair salon, and the (work clothing) store.

And due to all of that additional spending, personal income tax, business tax, and government sales tax revenue would be significantly higher, while small business bankruptcies would plummet as presently marginal businesses would see definite sales increases.

It would represent an incredible boon to the overall economy, and small business in the UK would receive additional billions of pounds per year — replacing all those billions going to homelessness and addiction programmes, to additional policing and court and incarceration costs, and to untold property damage and harm to persons from those people who feel they have ‘nothing to lose’ — all of which is paid for ultimately, by taxpayers.

If you’re a British taxpayer, where would you rather your tax money be spent? On astronomical policing, court and incarceration costs that the government won’t ever divulge (because there would be a taxpayer revolt!) or spending it to allow people to live decent lives for the same, or much less cost per year?

It isn’t about a ‘free ride’ for those who choose not to work, as Britain has millions more job-seekers than there are jobs available year-in and year-out (as in all developed nations) it’s about choosing to spend taxpayer money on the obscene social costs of poverty — or choosing to spend the same amount or less, on supporting local business.

It really is about the economy! It’s about appropriate job retraining programmes that meet the wildly varying needs of each particular decade. And it’s about one tuition-free college degree for a better educated Britain, via Gap Year military service.

How to pay for all of that?

Increasing social welfare spending to £1088. per month, means that policing, court and incarceration costs, homelessness and drug addiction costs, property crime costs and insurance rates, etc. would fall dramatically. Yes, there might even be an opportunity for savings once that programme would be completely rolled-out!

Highly adaptable job-retraining programmes geared towards the needs of the end-user (UK business) might well incur some additional costs compared to the presently available job-retraining programmes.

And the ‘One Tuition-Free University Degree’ costs would be borne by the UK military, as it would be the entity charged with paying for each cadet’s tuition after they have completed one full year of military service.

So yes, in totality, there would be some financial cost, but many societal benefits.

An unobtrusive 1% Tobin Tax could pay for simplified and more effective Social Welfare Spending, more appropriate Job-retraining and One Tuition-Free College Degree per student

There is one very-easy-on-the-taxpayer way to afford this (and, Bonus!) allow the government to never run a budget deficit again — by instituting a 1% Tobin Tax (a 1% tax on every financial transaction) that would cost each individual taxpayer a tiny fraction of their total investment spending, and for those who invest little it would affect them little.

As Prime Minister Theresa May has implied, Building a Better Britain is not about ‘doing the same things over and over while expecting a different result’ — it’s about looking at what works well in other developed nations and adapting it to Britain’s case. Sooner, rather than later.